George’s guy, Kevin, destroyed their occupations last year and that’s today having trouble expenses his financial. George try happy to help his boy by the lending him six months’ value of home loan repayments. Yet not, George ily mortgage triggers a gift and you may tax accountability.

If you are considering loaning a close relative money, you should know how the new Irs defines an enthusiastic intra-loved ones financing and also the statutes close for example that loan.

A genuine financing or something special?

Whenever lending money so you can members of the family, ponder, Is this transaction it’s a loan? If your Internal revenue service finishes that the deal isn’t really a bona fide loan, it will re also-define it a taxable provide. Because of the formalizing the order and you can treating it as that loan, you could stop bad tax consequences and have the required papers to support a bad-debt deduction should your borrower defaults.

The fresh Irs and process of law have a look at numerous situations within the determining whether or not a transaction is actually that loan otherwise something special. No matter if not one person factor was handling, a keen intra-nearest and dearest financing is far more likely to be seen as real if:

- You will find a created agreement

- Attention try billed

- There is a fixed fees schedule

- The fresh debtor executes a good promissory note

- The debtor makes the costs to pay the loan

Not all of such affairs need payday loans in Paonia Colorado to be establish, nevertheless the a lot more which can be, the higher the chance of the mortgage withstanding Internal revenue service scrutiny. Regardless of how much you plan, no strategy is bulletproof. The Irs is re also-characterize a loan since the a gift if this identifies your loan’s mission would be to stop fees.

Is actually adequate attention becoming charged?

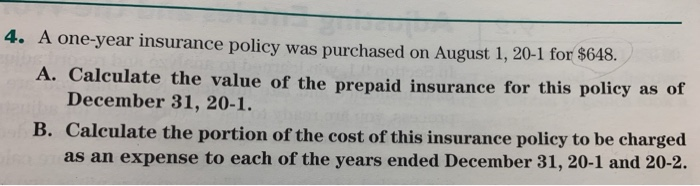

In the event that a keen intra-household members import was that loan, another question to consider are, Will you be billing sufficient appeal? That loan is below markets for many who costs below the absolute minimum interest, that is determined by new applicable government speed (AFR). The us government sporadically kits the AFR, together with price may vary according to form of and you will identity regarding the mortgage.

Such as for example, minimal price to possess a request loan (one that is payable toward demand or possess a long maturity) is the short-term AFR, combined semi-per year. Thus, minimal price may vary into the longevity of the mortgage. The best way to be sure you charge sufficient appeal getting good consult mortgage is by using a varying rate that is tied to the fresh new AFR. For a loan which have a set title, utilize the AFR that is ultimately into mortgage time.

Year-bullet thought having a mentor could help replace your complete money package. Get the full story by the getting all of our income tax guide.

Form of mortgage affects tax impact

Below-ily people enjoys one another earnings and you will present taxation outcomes that disagree depending on the mortgage form of. Getting a demand financing, each tax year you are addressed as if:

- You’d made a taxable present comparable to the degree of imputed interest

- The latest borrower transmitted the bucks back because an interest fee

Imputed desire is the difference in this new AFR and the matter of interest you truly assemble, recalculated per year. According to the loan’s objective, brand new borrower might be able to subtract this interest. If desire try imputed to you, you’ll be able to owe taxes toward fictitious payments. In addition, you might have to pay current taxation should your imputed focus is higher than this new $15,000 ($30,one hundred thousand to possess maried people) annual present taxation exception. There are two important conditions that enable you to prevent the imputed appeal legislation – or perhaps avoid their impression. Basic, fund as much as $10,100 are usually exempt; but not, all money ranging from you and the same borrower must full so you can $ten,100 or smaller.

Second, money up to $100,100000 was exempt whether your borrower’s web investment income toward season try $step 1,100000 or shorter. If the websites financial support money is higher than $step 1,000, brand new imputed desire legislation incorporate, but the number of notice is restricted toward number of online funding income.

Term funds was treated basically the same way as request loans getting tax purposes. Although present tax consequences are very some other. If you make a significantly less than-ily user, their current is equal to the other of one’s amount borrowed across the present property value most of the future financing payments (making use of the AFR while the write off price). If you create a decreased-desire if any-desire loan so you can a relative, avoid an expression loan you usually do not make a good nice upfront present.

A confident result

Whatever the reason for lending money to a member of family, make sure you see Internal revenue service statutes ruling intra-family unit members money. Coping with your own money consultative team so as that the loan wouldn’t incur earnings and current taxation liabilities will help end in an optimistic result for your requirements along with your relative.

Which file is for informational use only. Absolutely nothing in this publication is intended to form court, income tax, otherwise money pointers. There is absolutely no make sure that people claims produced will come to help you violation. All the information consisted of here might have been obtained from provide considered feel reputable, however, Mariner Money Advisers cannot warrant the precision of your guidance. Consult an economic, income tax otherwise law firm getting particular information pertaining to their condition.